Speed Worshiping Culture

15 Jan 26

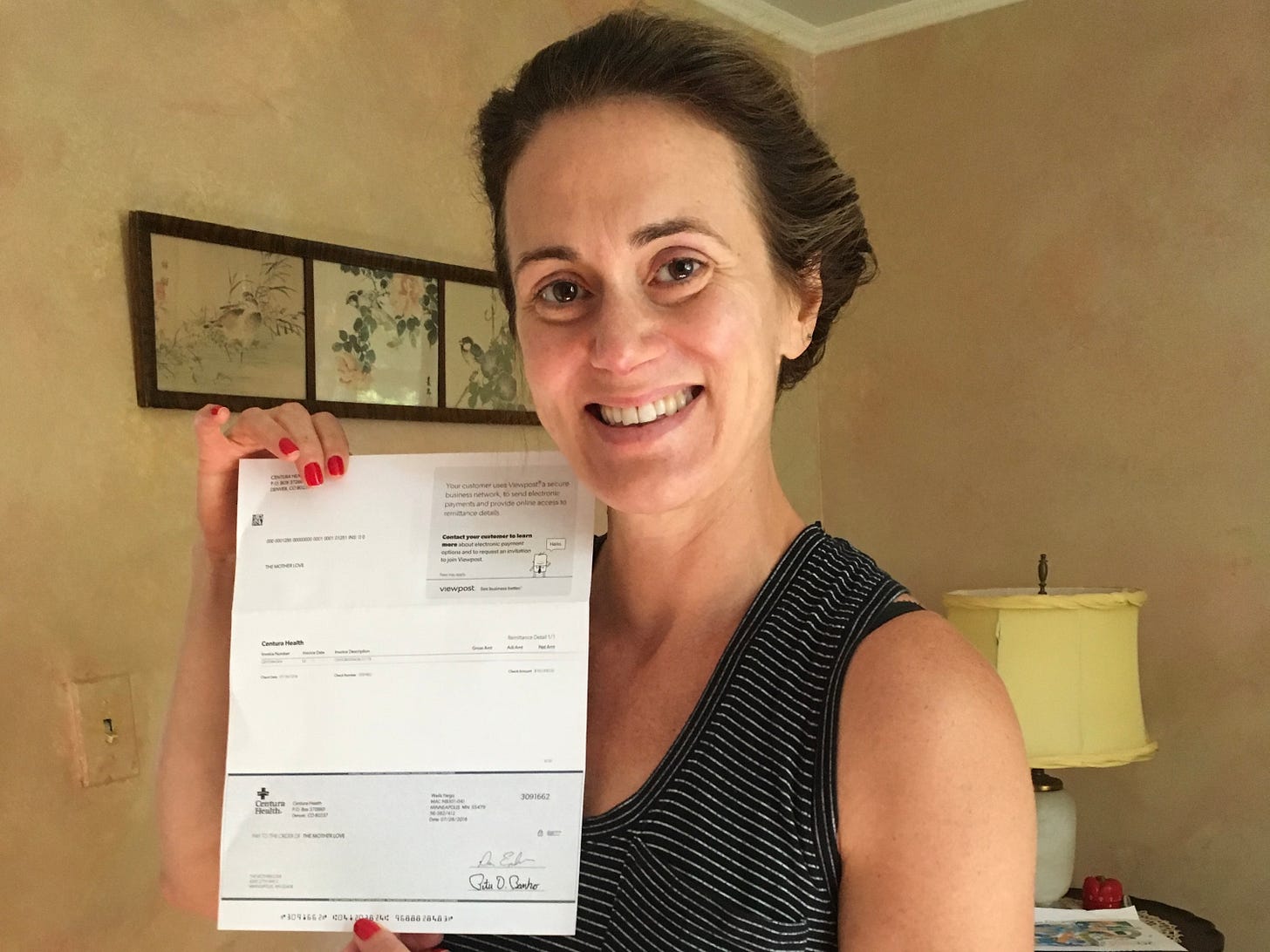

I was supposed to be celebrating. I'd just received my first six-figure contract with a major health system - the first female founder in maternal health to do it. Future ARR was looking solid. Instead, my back seized, and I was immobile.

I’ve been thinking about that moment today and yesterday as I learn more about my human design, and how I can apply it to building a company. Success and collapse arrived at the same time, like they were always traveling together.

The current and past 20-year entrepreneurial playbook says, “Move fast and break things.” Sprint, scale, prove traction. It’s designed for people who can run on willpower, who have safety nets to catch them when they fall, who can sacrifice everything for a 3-5 year exit. And to be honest, I am kind of bored.

Back then, I kept trying to match that pace. I'm an endurance athlete - we build for the extra mile. But I was running outdated software. Somewhere along the way, speed became the only metric that mattered. And, if you couldn’t keep up? You were told you weren’t serious enough. Weren’t hungry enough. You weren’t founder material.

But what if the problem isn’t us?

What if the system was just designed for someone else, someone who doesn’t look like us? Back in October, Phoebe Gates surprised me when she said, “Women aren’t taught to build companies.” It pushed me into motion. Because she’s right, and it’s not just women - it’s the majority of people who don’t fit the mold of who gets venture funding in the first place.

Let’s look at some data from 2025:

83.6% of global VC funding goes to all-male founding teams ($241.9 billion)

Even when women do get funded, they get half the check size ($5.2M vs $11.7M)

Early-stage funding for women is declining - from 26.5% in 2020 to 20.5% in 2024

Women hold only 17.3% of decision-making roles at VC firms

83.6% is a selection problem. The system is designed to fund one specific type of founder. Selection bias rules out most women, Black, Brown, and queer founders before they even start. The ones who do raise capital early often have safety nets - parents in tech or finance, family in VC, networks that open doors.

The rest of us? We’re told to figure it out. Or that we’re not cut out for this. At the current pace of funding, gender parity won't happen until 2065. That's 40 years from now.

I don’t buy it anymore.

It feels like we live in a speed worshipping culture that mistakes velocity for value. That confuses hustle with strategy. That makes you feel like you’re failing when really, you’re just building at a different pace. Rebellious entrepreneurship, after all, means running your own race, not someone else’s.

What would it mean to refuse to build a company on someone else’s timeline?

Listen. I love money. I love companies that build to be profitable. But what if we built for scale and for the long run instead of the quick exit? What if funding models looked different and were updated so that it is easier to raise different types of capital? What would it look like to generate revenue at a pace that plays the long game, and to build companies as if the whole team operates like a sturdy, regulated nervous system, not just a few individuals?

I’m still figuring all of this out. But I know this much: the old models feel like they’re wearing out. Maybe that’s not a crisis.

Maybe that’s an opening.

Just something in my consciousness. May you get some rest tonight!

Becca

Research

2025 Funding Data:

Founders Forum

PitchBook

Harvard Kennedy School